2025 Tax Calculator For Seniors Over 70. Enter your income and location to estimate your tax burden. Enter your annual income and filing details to estimate your tax burden.

To calculate your income tax, you can use the efile.com income tax calculator. Just enter details such as the number of dependents, your total income for the year, applicable.

2025 Tax Rates And Standard Deductions For Seniors Rubie Sharona, And is based on the tax brackets of 2025 and.

Tax rates for the 2025 year of assessment Just One Lap, Now, if you are 65 or older and blind, the extra standard deduction for 2025 is $3,900 if you are single or filing as head of household.

2025 Fed Tax Standard Deduction For Seniors Fae Mellisent, Aarp’s tax calculator can help you predict what you’re likely to pay for the 2025 tax year.

How Much Is The Ctc For 2025 Tax Year Yoshi Katheryn, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Standard Deduction 2025 For Seniors Over 70 Lola Sibbie, And is based on the tax brackets of 2025 and.

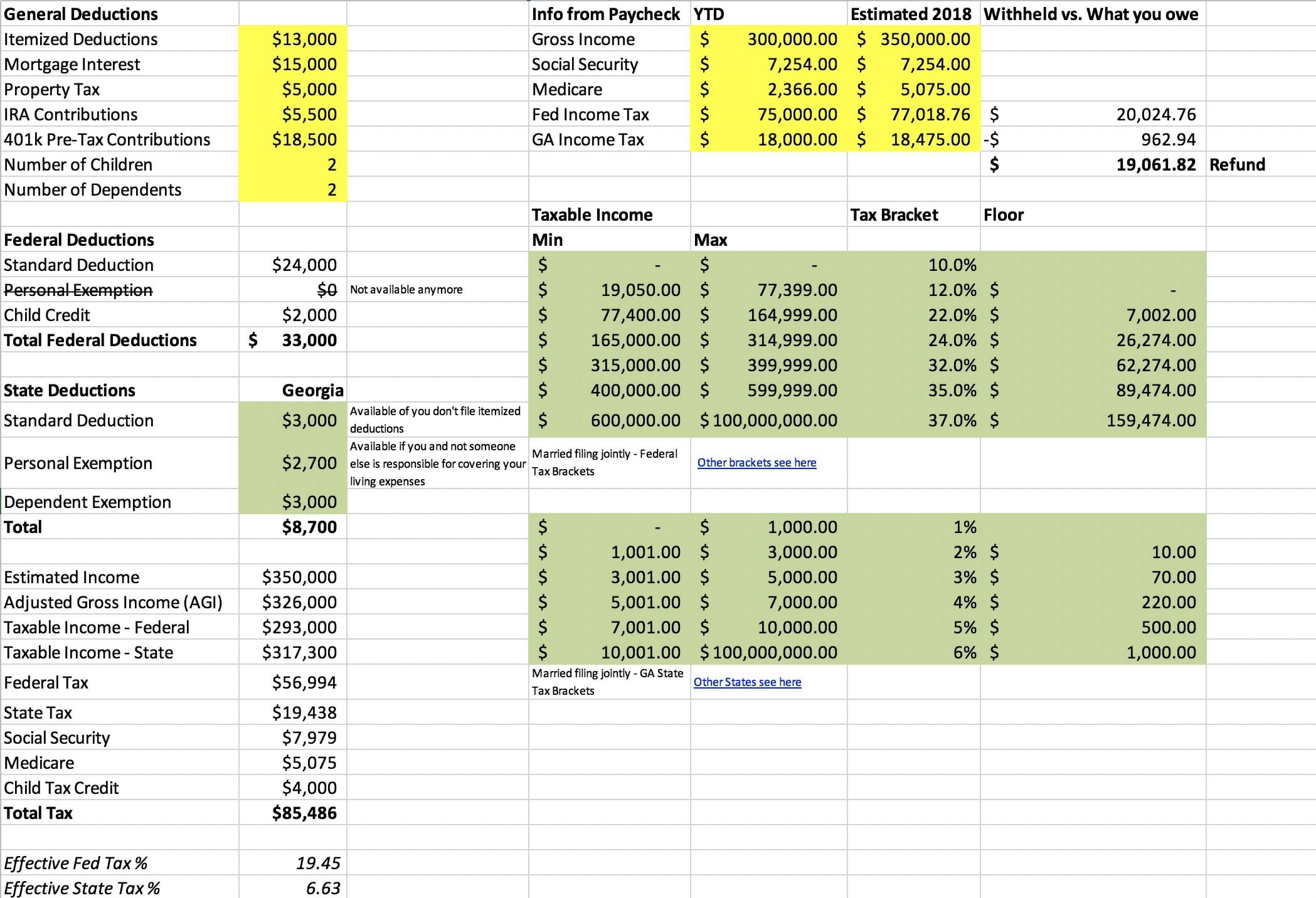

Tax Calculator 2025 Excel Image to u, Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april.

Tax Calculator 2025 25 2025 Company Salaries, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

2025 Federal Tax Brackets And Rates Rasla Cathleen, You can use our income tax calculator to estimate how much you’ll owe or whether you’ll qualify for a refund.

Senior Citizen Tax Calculation 202324 Examples New Tax Slabs & Tax Rebate YouTube, Individuals 65 or older at the end of 2025 must have gross income of at least $15,700 (versus $13,850 for younger workers) to be.